Key Financial Metrics All Business Owners Need to Review

The weather is changing and we are firmly in the last quarter of the year we may never forget, 2020. I am amazed at how many "unseen" events has took place in a year on 20 - 20 ...

I am glad my eyesight 20-20 is better than what I have seen this year unveil.

Possibly by the time you take a few minutes to read this the biggest election, I believe, in our Country will be over ... hopefully to solidify our Country and get this craziness behind us. If by chance you are reading this before Tuesday, and you haven't voted ... Please exercise your citizen's right of this Country and vote.

In this quick read, there are two critical articles you should take time to read and digest. If anything this year has taught small business owners, it is that financial hardships can come from many unexpected events. It is time as a business owner to strengthen your understanding of the financial metrics involved in your business and prepare better with them and improve your business's overall health.

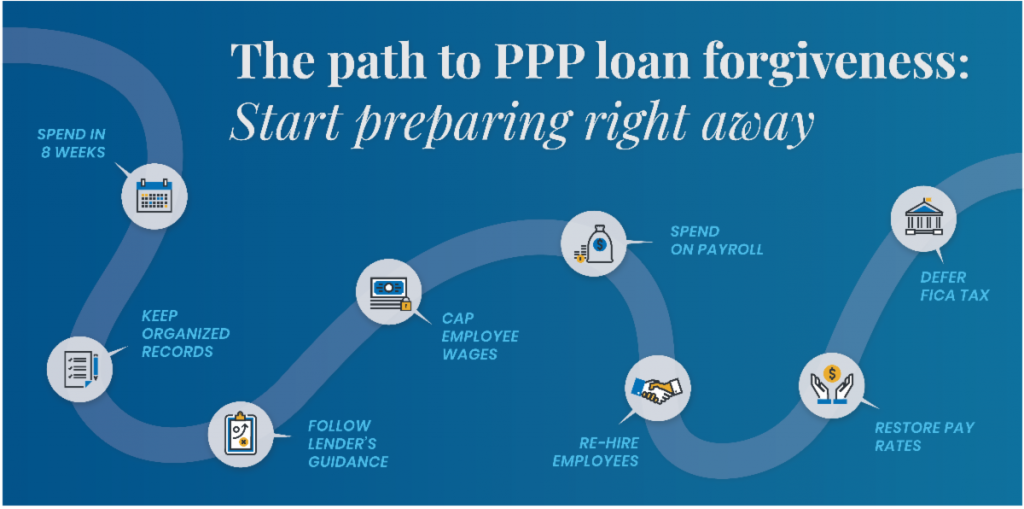

We also included a quick update for the PPP Loan Forgiveness requirements which its deadlines may be coming quickly for many of you.

Our Product Spotlight in this issue is designed to save you hundreds of dollars and improve security at the same time.

As always, tell us what you would like to see in our future Quick Read Issues in the future, and we are here to help in any way we can.

Sincerely,

Top Five Key Financial Metrics Business Owners Need to Track

Operating a small business is an exhilarating and, at times, overwhelming endeavor. There are so many details to keep track of that it's easy to forget about the nuts and bolts of your organization's finances - especially if you didn't start out as a "numbers person."

Whether you're the one who is assembling your financial reports or you've hired a professional to do it for you, it's important for you to know which of the numbers are most important and what they mean in terms of the decisions you make.

You must also make an assessment of the health of your business overall. Below you'll find our list of the top five most important elements of your financial review, and what you can do with the information.

- Profit and Loss

Every quarter, you should review and analyze your business' profit and loss report to understand your operating strengths and weaknesses, as well as your tax implications. It is the single, at-a-glance picture of many areas of your business and should be used to drive your business decisions and that you can show to an outsider for them to gauge your strength. However you also must have a reconciled Balance Sheet to put everything into perspective and show the "whole business picture".

Unfortunately most small business owners look at their Total Sales, Their Gross Profit Percentage, and then their Net Profit. This is far from sufficient to rum your business effectively. - Budget Versus Actual

Think you're sticking to the plan based on what you see in terms of your bank account? We see too many small business owners trying to manage their business future by checking their online bank balance every day. The truth is that if you compare what you've budgeted as compared to what you've actually spent it will give you a far better sense of whether you're staying on track and what kind of adjustments you need to make. - Cash Flow

Most people consider cash flow the most telling metric of all, and cash certainly is the lifeblood of any company. If you're not keeping your eye on your cash flow you could find yourself caught unaware and flatfooted when it comes to making essential payments, so make measuring your cash flow (as well as your cash burn - the amount you go through monthly) and your runway (how much you can operate based on your cash on hand) part of your regular business health check.

Poor/No Cash Flow is the leading causes of new business failures, but also is key for any established business as well. When you run "Out of Cash", your business health is on the verge of cardiac arrest.

No matter how well you are doing, there is always the chance that you're going to encounter some unforeseen circumstance or drop in business that is going to drive the need to cut costs. The best way to do that is to take a close look at your fixed burn rate and make sure that it isn't too high.

As tempting as it may be to sign on to a long-term contract to save a little money, if you commit yourself to a payment that you can't afford at all in the future you may be sorry. You may be better off taking some of those expenses off of a contracted status so that you can eliminate them if you have to.

The way to look at this also includes knowing your business "Break Even Point". Knowing this will allow you to track where you are compared to where you must be at a given point.

4. Employee Productivity

Though it's a given that your employees are your most valuable asset, that doesn't mean that you should be operating without ensuring that you are getting enough value out of them to justify what you are spending. The best way to do that is to actually monitor each employee's productivity to make sure that everybody is more than pulling their weight.

5. Financial Ratios and Benchmarks

Ratios are among the most useful metrics that a small business owner can use to determine the overall financial health of their organization. Among the most important are their liquidity ratio (how much cash you have on hand to pay the monies you owe); your efficiency ratio (how much it is costing you to bring in a single dollar); and your profitability ratio (profit as it compares to revenue).

Then there are Benchmarks that will compare your operation to other like business operations and well established normal financial indicators. Take a look at a Visual Dashboard Report we have developed and provided for years now.

Each of these elements is extremely beneficial in helping you understand where your money is at any time. If you'd like to discuss how our services can help you run a successful business, please contact us for more information.

The SBA Issues a Simplified PPP Loan-Forgiveness Application

Article Highlights:

- Paycheck Protection Program Loans

- Forgiveness Application

- Small Business Administration (SBA)

- The PPP Flexibility Act

- SBA Forgiveness Form 3508

- SBA Forgiveness Form 3508EZ

- SBA Forgiveness Form 3508S

If you are the owner of a small business that obtained a Paycheck Protection Program (PPP) loan, you are most likely aware that the loan can be partially or totally forgiven if you used the loan proceeds for the required purposes. Loan forgiveness is not automatic and must be applied for. The borrower must submit a request to the lender or, if different, the lender that is servicing the loan, which then must make a decision upon the amount of forgiveness within 60 days.

The request must include documents to verify the number of full-time-equivalent (FTE) employees and pay rates, as well as the payments on eligible mortgage, lease, and utility obligations. The borrower must certify that the documents are true and that the borrower used

the forgiveness amount to keep employees and make eligible mortgage interest, rent, and utility payments.

The whole process of obtaining a PPP loan and applying for forgiveness has been complicated from the start, with guidance from the Small Business Administration (SBA) and the IRS coming in dribs and drabs; for a while, it seemed that the rules were modified every week. The original forgiveness application provided by the SBA was horrendously complicated, and one almost needed an accounting degree to figure it out. It required the applicant to complete numerous complicated side computations and did not provide any corresponding worksheets.

To clarify the process, Congress stepped in and passed the Paycheck Protection Program Flexibility Act. As part of that legislation, the SBA was required to simplify the forgiveness application. In response, the SBA did somewhat simplify SBA Form 3508, this is the original forgiveness application, and came up with an easier version: SBA Form 3508EZ.

The 3508EZ is for use by:

- Self-employed borrowers with no employees

- Generally, borrowers with employees that, during the covered period,

- Did not reduce the annual salary or hourly wages of any employee by more than 25%;

- Did not reduce the number of employees or the average paid hours of employees; and

- Was unable to operate during the covered period at the same level of business activity as it did before February 15, 2020, due to compliance with requirements established or guidance issued by the Secretary of Health and Human Services, the director of the Centers for Disease Control and Prevention, or the Occupational Safety and Health

Administration.

During the week of October 5th, the SBA released yet another simplified application- Form 3508S-along with 3508S Instructions for its use. This form can only be used if the total PPP

loan amount that the borrower received from their lender was $50,000 or less.

However, a borrower that, together with its affiliates, received PPP loans totaling $2 million or more cannot use Form 3508S and instead must use either Form 3508 and its 3508 Instructions or Form 3508EZ and its 3508Z Instructions (or their lender's equivalent form).

A borrower that qualifies for and uses SBA Form 3508S (or their lender's equivalent form) is exempt from any reductions in the borrower's loan forgiveness amount based on reductions in FTE employees or in employee salaries or wages from the CARES Act that would otherwise apply.

While SBA Form 3508S does not require borrowers to show the calculations they used to determine their loan forgiveness amount, the SBA may request information and documents to review those calculations as part of its loan-review process. Accordingly, the borrower must retain, for 6 years from the date when the loan is forgiven or repaid, all documentation (1) submitted with the loan application, (2) to prove the borrower's certification of eligibility for the PPP loan and material compliance with the PPP's requirements, and (3) to back up the loan-forgiveness application.

Keep in mind that the application for forgiveness, which can be submitted electronically, must be submitted within 10 months after the end of the loan-covered period to the borrower's lender or the lender servicing the borrower's loan.

If you have questions about how these changes might apply to your situation or need assistance with completing your forgiveness application, please give this office a call.

Contact us for additional information and support.

Stop Wasting $$Hundreds on Pre-Printed Checks !

If you don't print your checks and Deposit Forms out of QuickBooks, you should consider it for accuracy, convenience, and security.

If you are already, you probably are spending hundreds of dollars more than you should. If you have multiple accounts maybe even thousands!

We have worked with many companies over the years that offered software that allowed printing checks on more secure blank stock, but all of them in the past either charged an upgrade fee when you updated your QuickBooks, or required special blank stock ordered at a higher price than what we have now.

PrintBoss is the best software we have found that integrates perfectly into QuickBooks (and QuickBooks Online), and lowers your costs at the same time ...

Typically we find clients paying $300.00 or more for pre-printed checks for each account they have, and pre-printed Deposit Forms in addition,. That is ridiculous.

Deposit Forms Too !!!

This program will print deposit forms as well and the checks. The costs savings are 75% to 90% less than pre-printed checks/deposit forms, and much more secure, because if stolen, the checks are completely blank paper!

The program allows you to setup multiple bank accounts (100) if needed and recognizing multiple company files as well. The program can be set to require a password to print, and it remembers the correct bank account that should be used.

This is by far the most cost effective solution to print checks and deposit forms with QuickBooks. Save even more with purchasing larger check stock quantities.

We also highly recommend the HP Laserjet Enterprise P3015x Printer to hold both your check stock and deposit form stock.

Our company AEII, QuickBooks R Us, is always here to assist any small business with a full range of services, and provide the training and support needed to achieve excellent results. We have assisted businesses worldwide ... And we specialize in the collision repair and service industry.

Schedule a free session to discuss any QuickBooks or small business needs you may have below:

We have a large library of helpful QuickBooks Tips & Tricks, you can catch up on past issues by Clicking Here.

We also have a free self-help site with helpful procedures and videos at: QbHelp.us

Thank You and I look forward in sharing small business and QuickBooks Tips and Tricks with in the future ...

Leave a Reply