Payroll

How Are You Doing Your Payroll ?

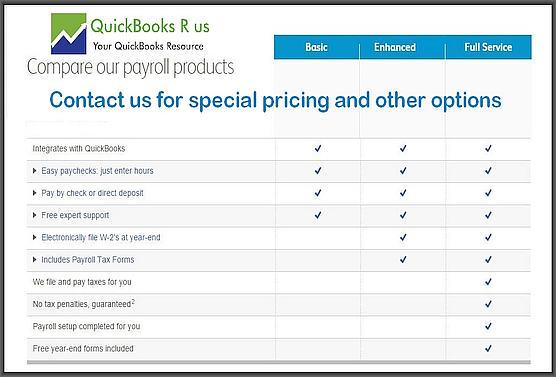

The most obvious selection is to use Intuit Payroll. There are three basic Intuit payroll options ... Basic, Enhanced, and Full Service.

The Enhanced is the most common option used by small businesses since it included the tax filing forms for State and Federal. This however means you are responsible to do the payroll using Intuit's tax tables*, pay your taxes on time, and file all the returns. The complete liability is on you.

The Full Service Payroll Option is like other 3rd party offerings, however this Intuit option does not support all State forms. For this reason, if you are looking for a full payroll solution there may be other better offerings available.

A Better 3rd Party Full Payroll Solution

We have reviews dozens of third party payroll services only to find that they have flaws that do not fit well with the industry, or they do not properly integrate into QuickBooks and requires setting up a Payroll Clearing Account and journal entries to properly distribute the payroll to proper accounts.

ADPrun is the best, very cost effective, and most reliable solution we have found for all businesses under 50 employees.

Why Choose ADPrun ?

- Simple to Use

- Imports into QuickBooks better than any other

- No more Required QuickBooks Upgrades*

- Very Cost Effective and Simple Pricing

- No Hidden Fees

* Intuit ends tax table support and updates every third year, hence requiring an Upgrade to the latest version if you are using Intuit Payroll Programs