S-Corp Officer Medical Insurance

S-Corp Officer Medical Insurance

One of the Most Common QuickBooks Payroll Mistakes

Many Collision Repair Companies are structured as a S-Corp (Sub S Corporation) for at least tax purposes.

Even if your company is a LLC (Limited Liability Company) you still need to determine how you will be filing taxes. This would be either as a Sole Proprietorship, Partnership, or either a Regular Corporation, or Sub-S Corporation.

There are major advantages to S-Corps, but this is not the focus of this post. This post is designed for those that are S-Corps and the company pays for or at least contributes to the costs for medical/dental/vision insurance and/or life insurance for officers that own at least 2% of the stock.

This scenario requires some special setup of the payroll so that these benefits are properly reported on the Officer's W-2 at the end of the year.

QuickBooks Payroll can handle this automatically in the background if it is set up properly. What is unfortunate is that many CPAs and Accountants are not only able to set this up, but many are not even aware of this requirement.

Setting Up QuickBooks Payroll

If you use QuickBooks Enhanced Payroll setting this up properly is pretty straight forward once you are shown how.

Step 1: Payroll Items Are Key to the Success

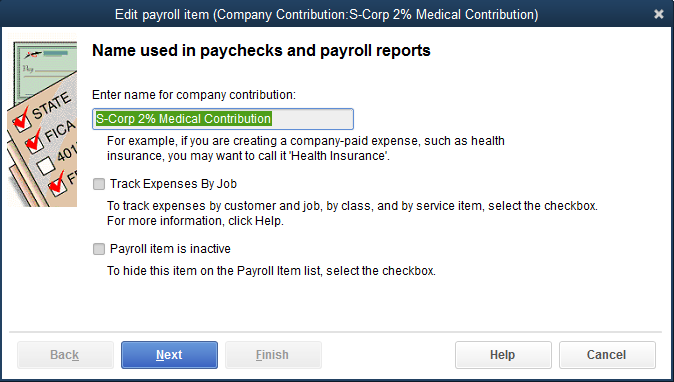

- Setup Payroll Item - S-Corp 2% Medical Contribution

- Add New > Company Contribution

- Do not use E-Z Method

Step 2: Vendor and GL Account Setup

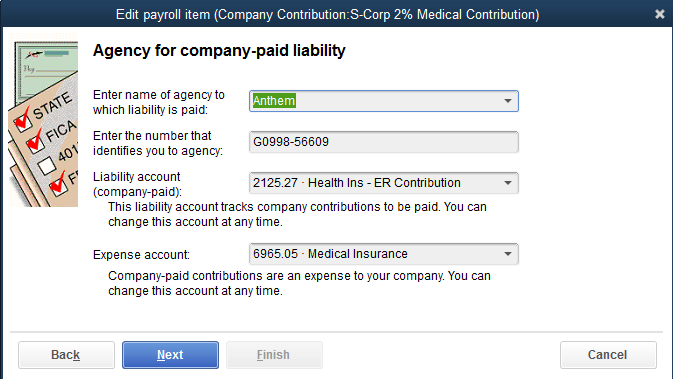

- Enter the Vendor you pay the premium to as well as your account number for the vendor

- Select the Current Liability Account and Expense Account from the Drop Down Menu

- Payroll Liability Account can be the same account as for any other medical insurance contribution made by the company

for any employees.

- Expense Account would be Officers Benefits - Medical Insurance

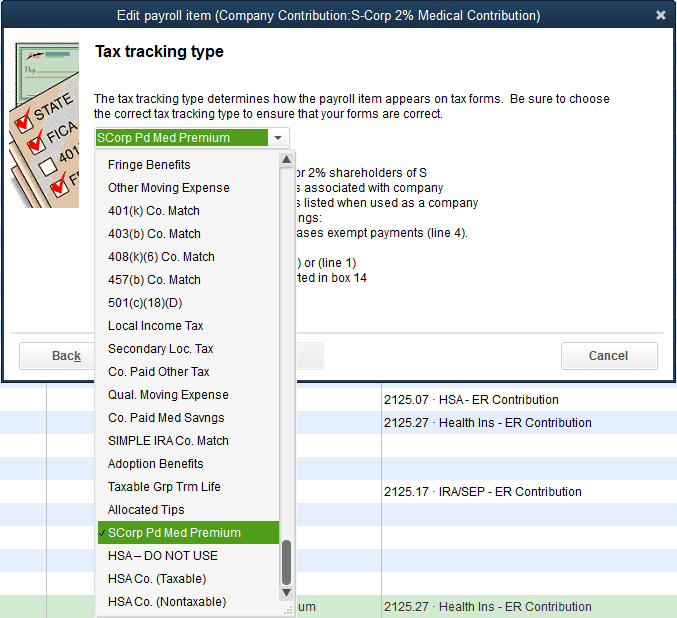

Step 3: Select the Proper Tax Tracking Type

This is a critical step often not completed correctly...

- The Tax Tracking Default will be "None". This must be changed to "SCorp Pd Med Premium"

- This will begin to track this cost properly, otherwise it will not.

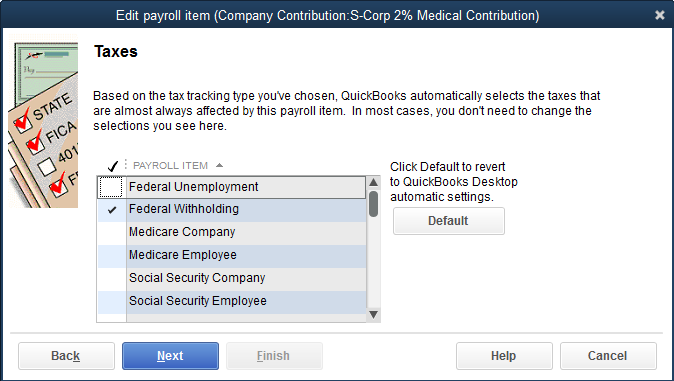

Step 4: Taxes Affected

- QuickBooks will automatically select what is normally affected.

- If you are sure that the amount of Federal and State Taxes will be sufficient for the year without extra deductions, you can

deselect the Federal and state taxes checked.

- You should either contact us to discuss this deselection.

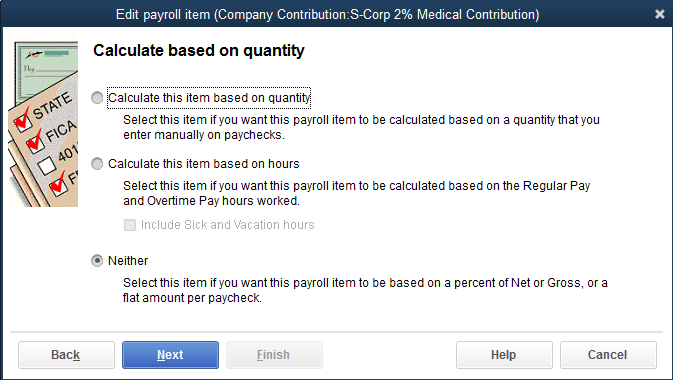

Step 5: Calculated Based on Quantity

- Select "Neither"

- This is not applicable for this Payroll Item

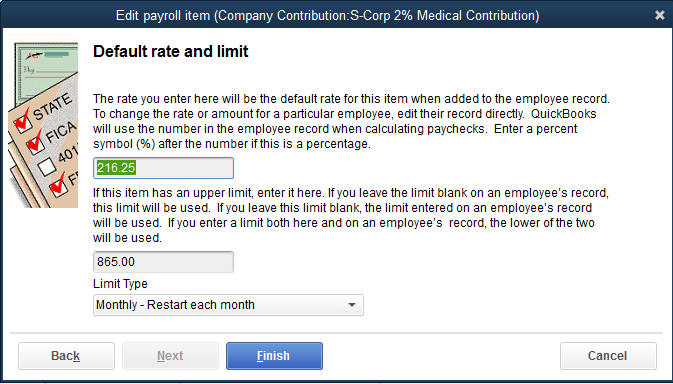

Step 6: Default Rate and Limit

This is the second most critical input for allowing this Payroll Item to work properly.

- In this example the monthly premium paid by the company for this officer's insurance is $865.00

- This company payroll is "weekly" - Divide the monthly premium by 4 ... equals $216.25

- If the amount does not divide evenly adjust the amount by +$.01 ... - Enter in the Total Premium for the month in the next box.

- This allocates $216.25 each of the first four weeks monthly, and nothing the fifth week becasue it has reached the limit.

- This is why you round the weekly payment up by .01 so the fourth week will correctly adjust to the limit. - Make sure to select "Monthly - Restart Monthly"

- This will then allow a monthly limit to begin again. - Select "Finish"

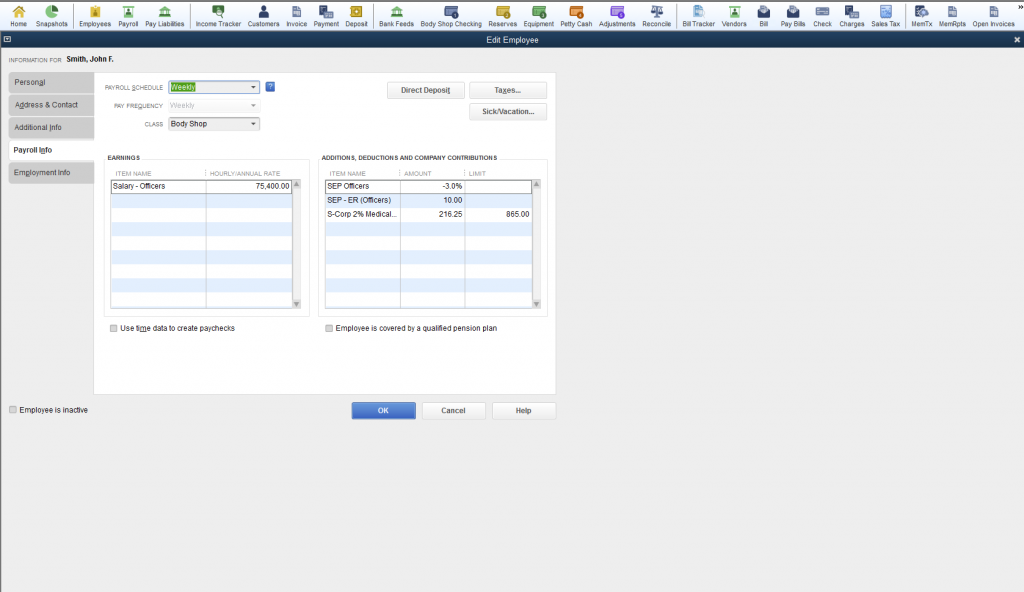

Final Step: Set up Officer's Payroll Information in each record

- Go to each Officer (Must Own at least 2% Stock)

- On Payroll Info Tab - Make sure item is listed in the right section, and the amount and limit are listed properly.

That is it !

Watch the Video to See in Action

In Review:

- The Key Points to This Process Are:

- Set up the Payroll Item Properly

- Add the Item to All Officers that own at least 2% stock and the company is paying at least partially their medical/dental/vision insurance.

I hope this explained a more streamlined process to follow tracking this for S-Corps.