Loans, Leases, and Depreciation/Amortization Mistakes

Loans, Leases, and Depreciation/Amortization Mistakes

Another Important Month End Adjustment Most Are Unaware of the Consequences

In this month's QuickBooks & Tricks we will discuss a very common set of mistakes made by many clients that also skew their financial statements as well.

When a financial statement such as a Profit and Loss Report (Income Statement) is produced it is important that transactions that are listed in the report are actually valid and accurate. Otherwise the report information is not of any benefit to analyze your business. The same is true with the Balance Sheet. If transactions are missing or not valid, the report is of no value as well.

To begin, there a few fundemental concepts to review first ... what transactions are valid and what are commonly missing.

What is Income/Revenue ?

In every business, you have primary products and/or services that you sell to customers. These are earned when you finish the services or complete the sale of the products. These would be considered as regular income/revenue. Other monies you may deposit into your bank, not related to your sales of products and services, are either "Other Income" or not income/revenue at all and not valid.

In QuickBooks, you should only use the "Receive Payments" process when receiving monies for your actual Sales by way of a Customer Invoice. DO NOT USE this function for receiving other monies including loans or "Other Income".

If the monies you are receiving are "Other Income", such as Interest you receive for any of your bank accounts, rebates, accounting discounts, or other financial charges you have billed, they should be added to the Deposit Form directly in QuickBooks. They should be added how they will appear on your bank statements so you can reconcile them easily, and they can be added to a regular income deposit as well (Undeposited Funds).

If they were electronically deposited (EFT or ACH) into your account, create a deposit to match the transaction as it entered your bank account. This again makes it much easier to reconcile your bank account at the end of each month.

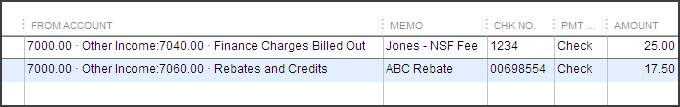

Figure 1 - Typical Deposit Form adding "Other Income" (Checks Received)

In the above example, two checks were received that are not regular income/revenue. The first line is a financial charge to a customer for a NSF check, while the second was a rebate check from purchases. These are distributed to the appropriate "Other Income" accounts.

Monies deposited into the bank from loans are also not Income/Revenue or Other Income. They should be deposited directly into the bank account and distributed to the Liability Account for the loan.

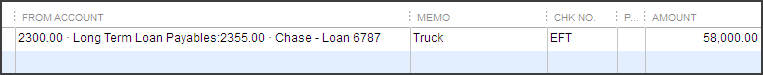

Figure 2 - Typical Deposit Form for Loan Deposit (EFT From Bank)

In this example, a loan was taken out and the monies were electronically deposited into the bank account. When taking out a loan, it should be set up as a Liability. Typically it will be a Long Term Liability unless the repayment period is twelve months or less. In that case it should be set up as a Current Liability.

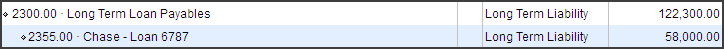

Figure 3 - Typical Long Term Liability Account Setup

We suggest that the last four digits of the loan number be used to identify the account. This makes it easier to ensure payments are posted to the correct account especially when there are multiple loans involved.

Keep in mind that this account should only include the principle balance and the principle payments. This account balance should reconcile each month to your actual owed balance for the loan.

What are Expenses ?

On the flip side of Income/Revenue, there are expenses to your business. Expenses are considered costs to produce or sell your products and/or services. Direct expenses such as Cost of Goods Sold (COGS) and/or building, utilities, office staff, insurance, etc are all costs to your business., and are regular expenses.

Loan payments ARE NOT a business expense. Since the loan monies were not "Earned", neither is the repayment of the loan a business expense. The interest and other loan fees are a business expense, but not the principle portion of the loan payment.

This is a very common mistake made by many clients, and requires one to obtain a loan amortization schedule from the lender. Sometimes their billing provides this information, and sometimes it is available online when you log into your account. In any event, you MUST obtain this information to properly distribute the loan payments. The payment amount may stay the same each month, but the amount for principle will generally increase each month while the interest will decrease each month.

Typically in QuickBooks, the check distribution is split with a line for the principle portion, and the interest porttion. It may also include other loan fees as well.

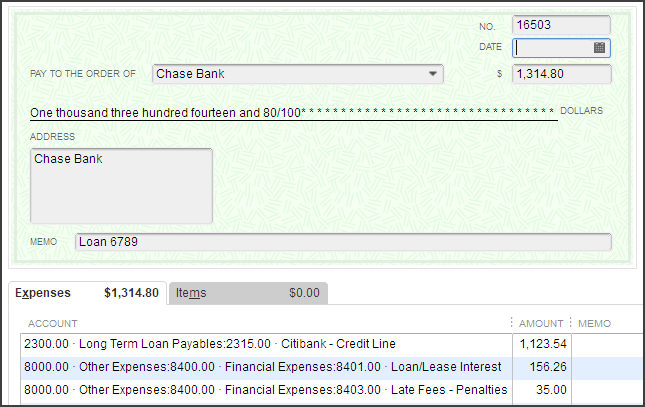

Figure 4 - Typical QuickBooks Check Entry - Loan Repayment

In this example, $1123.54 is the principle payment for the loan 6789, $156.26 is the interest paid on the loan, and $35.00 was a late fee applied to the loan payment. At the end of each month the loan balance should be reconciled with the bank loan balance which is also normally provided on the loan amortization schedule.

Leases

This also is one of the most common mistakes made by clients all the time...just because the paperwork states it is a "Lease Agreement", it doesn't mean it actually is a "Lease" according to the IRS, and how you must treat it in QuickBooks.

In most cases, "Leases" for equipment have a very low end of lease "buyout"; often $100.00 or less. These are not considered leases. The advantage of a true operating lease is that the business can simply deduct the full payment each month, instead of capitalizing the purchased item and depreciating it.

"Operating Leases" makes it easy for accounting, however unless you are never going to pay off the "Lease" and own the item purchased, the IRS considers it a "Capital Lease", and you must treat it just like a loan and depreciate it. Common items that need to be treated as "Capital Lease" are normally both vehicles and most equipment.

There are times when some equipment may be considered an "Operating Lease" when you, as the business, are never to have an option to own it. We have seen office copier leases, furniture rental (lease), storage units, closed end vehicle leases, etc. In these cases it is basically "rental" without ownership.

So why are equipment leases so much more common ? They are simply easier to get from the seller, and the seller makes it as easy as possible to sell the equipment and offer these financial options, rather than the business going to the bank for financing .

They often have many options based on the financial strength of the business and owner. However they are also almost always a "Capital Lease" , and you should set it up as a Liability as a Loan explanation earlier.

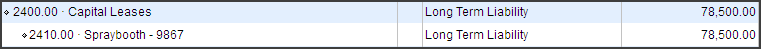

Figure 5 - Typical QuickBooks Capital Lease Liability Account

Generally we recommend a separate section of "Capital Leases" as the above example. The same is true how the actual payment is distributed as well. The Liability Account only includes the principle balance, and the interest and other fees are distributed as with a loan. It is often more difficult however is deciphering the lease amortization schedule. Some we have seen are very difficult to determine the correct distribution.

In addition, when you purchase a piece of equipment you pay the sales tax when purchasing. This sales tax is included in the total value of the Fixed Asset. With leases, they often have you pay sales tax each month.

The sales tax paid each month is still part of the "Total Fixed Asset Value" and will normally be distributed to the same Fixed Asset Account as the item purchased. It is sometimes an option to pay the sales tax at the beginning of the lease or monthly. If you do elect to pay it at the time of purchase (lease), it will be easier in accounting, but this also then requires a larger initial payment. Paying sales tax (use tax) allows the seller to get you into the deal at a lower cost.

Net Ordinary Income

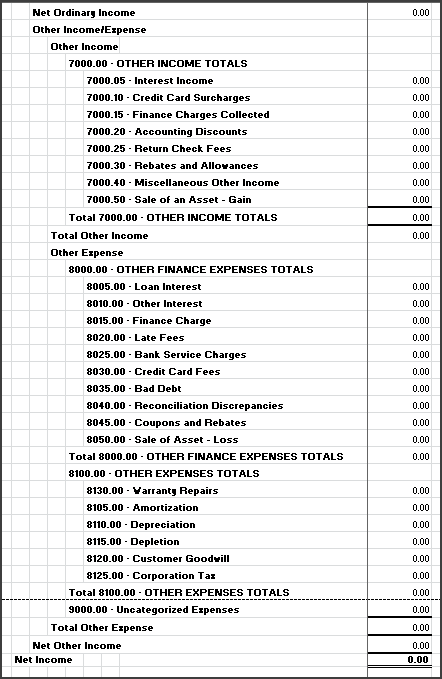

In QuickBooks there is a Total for "Net Ordinary Income" right before "Other Income" and "Other Expenses" are listed. This is your net operating profit, but typically does not include a number of business related other income or expenses that are also important.

Figure 6 - Typical QuickBooks Other Income and Other Expense Accounts

This example shows a listing of possible "Other Income" and "Other Expenses" Accounts. This can be subjective to many since some of the "Other Expenses" could be listed as a regular expense. We just often place many of these here to group them with like financial expenses, and to make them stand out from the regular expenses for easier review.

Net Profit Does Not Equal Cash in Bank

One very fatal misconception by many small business owners is that their "Net Profit" is the same as "Cash in Bank", or will be reflected in their "Cash in Bank". That is a very huge error in understanding the Profit and Loss Report, and often can bankrupt or create financial hardship to the business.

The Profit and Loss as explained earlier does not include loan or capital lease payments. However, it doesn't include owner disbursements/draws, internal loans, or employee advances, which all can affect the businesses cash position greatly. The Net Profit listed is without considering these payments but still are deducted from the bank account. Many small businesses have positive Net Profit, but run out of operating capital to keep their doors open. This can be dramatic during a strong business growth stage.

Yes, the business could be making a profit, but if the demand on its cash is too much, or it has over leveraged their credit and have huge debts to repay... it can be forced to close. Unfortunately, this is when monies that are not the businesses such as collected Sales Tax, Employee and Employer Tax monies are often used to meet the cash demand. This almost always creates a spiraling business that gets into financial troubles, and often can't recover.

It is important to see the whole picture of your business's financial position and not just a portion. There are other transactions that will impact your "Cash Position". This is viewed within QuickBooks using the "Statement of Cash Flows" Report. With this report along with the Balance Sheet and Profit & Loss Reports you will be able to see a true picture of your business, and then able to make good decisions utilizing good information.

Depreciation/Amortization

It is common for small businesses to only review "Net Profit" without "Depreciation" and/or "Amortization" included each month. Most clients are dependent upon their accountant or CPA to provide these entries at year end only, but it should not be.

As explained earlier, the full payments made for loans and/or capital leases are not a deductible expense, and should not appear on a Profit and Loss Statement, but if these were for tangible and/or non-tangible assets, they can be "written off" with depreciation/amortization each month as a financial expense.

Unfortunately most small business owners do not understand that Accountants and CPAs are generally only focusing on your tax liability, and have almost zero knowledge of your business, or the importance of having operating reports that help you manage your business. The financial reports most Accountants and/or CPAs produce are for tax purposes, not for analyzing your business.

Generally small businesses rely on their Accountant and/or CPA to track their assets on a "Depreciation Schedule" and often get a closing entry from them for the Depreciation/Amortization Expenses at year end only. This really is not what you need to analyze your business and manage its growth. You first must accept that your QuickBooks will not mirror your tax return, and will be set up and used to analyze your business operations. QuickBooks can easily be a good management tool if setup properly.

For tax purposes there are a host of options available to reduce your tax liability with different types of depreciation schedules. Special depreciation options include what is referred to as Section 179, which allows you for tax purposes to depreciation up to $500,000 in one year.

This tax break is designed to encourage small businesses to invest in new capitalized equipment. However, taking a huge depreciation expense in QuickBooks doesn't accurately reflect your true operating profit and loss, or your balance sheet. For this reason we suggest your assets in QuickBooks are depreciated and/or amortized in what is called "Straight-Line".

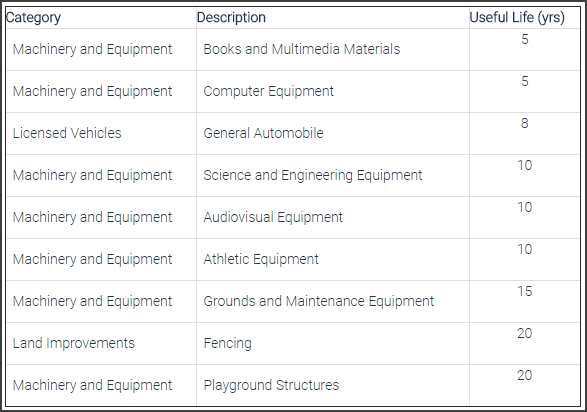

Figure 7 - General Chart for Useful Life to Determine Depreciation Length

Depending on the type of asset, there are rules for how long they normally are depreciated/amortized. This is based on its useful life expectancy. This determines the number of years/months it will be depreciated. This typically can be from 5 years to 27.5 years.

To determine the amount of depreciation after determining the normal depreciation/amortization length, you must estimate the salvage value at the end of the depreciation/amortization time. Then you take the beginning asset value and subtract the estimated salvage value to create the "Basis" for the depreciation amount. This is then divided by the length in which you will depreciate/amortize the asset.

As an example, $40,000.00 asset that has a salvage value of $5500.00 would have a "Basis" of $34,500.00. If the item has a useful life of 5 years, then the yearly depreciation is $6900.00. But you should create an automatic memorized transaction monthly for $575.00 to be taken on your Profit and Loss each month.

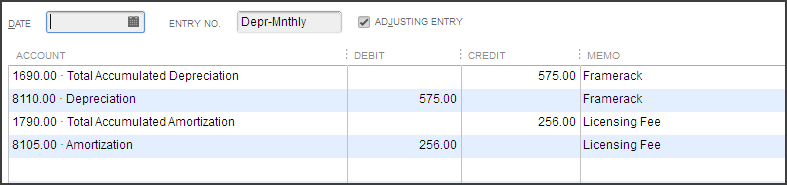

Figure 8 - Typical Memorized Journal Entry - Depreciation and Amortization

As to when to depreciate verse amortize ... Basically "Depreciation" is taken on tangible items such as equipment, buildings, furniture, computers, and vehicles. "Amortization" is taken on non-tangible assets, things that have value such as Goodwill (when purchasing business), software, trademarks, patents, licensing rights, etc. They basically are processed the same way, the IRS requires them to be separated on the financial reports.

There is actually nothing to say that you cannot match the depreciation time length to the same number of months you are paying your loan/lease as well.

If your QuickBooks is setup for operating your business, and not a tax setup, your books will be different than your tax returns any way. Accountants and CPAs can handle this in their tax software. We find it much more beneficial to the business to have QuickBooks setup this way to allow you to analyze and manage your business, rather than for your tax return.

Next month, Cleaning up your books for year end !

If you have missed our earlier issues of QuickBooks Tips & Tricks, you can catch up on past issues by Clicking Here .

Thank You and I look forward in sharing QuickBooks Tips and Tricks with you next month ...