Handling Short Pays & Sales Tax Credits

Handling Short Pays & Sales Tax Credits

Another Important Process to Follow That Most Do Incorrectly

In the Collision Industry there seems to always be times where the amount expected to be paid is shorted by scores of reasons. For this reason shops with management systems have often "held" Repair Orders open waiting for the final confirmation of what the actual payment will be. This is simply not the correct practice or procedure to handle these situations.

There are basic rules that are necessary to allow for timely and accurate information during the month close. If these rules are not followed, it delays the ability to achieve the goal of the final financial statements being made available by the 5th of the following month. It is important to understand that the later in the following month the final financial statements are produced, the less valuable they are to the business. Accounting statements are always "history", they need not be ancient history.

Rule 1:

Repair Orders should be closed when the customer leaves the parking lot with their vehicle. - The repair order should be closed with the amount you expect to be paid

Rule 2:

If the amount you are paid differs from what it was closed for, do not change it in either the management system or your accounting system.

Rule 3:

The management system sales report and the accounting system sales report should match at the end of each month.

Both the management system and your accounting system require some setup to be able to follow these procedures. However, this process will require much less time than changing the repair orders to match what has been "Short Paid. In addition, if the repair order is just left open or changed after it has been exported, you will never be able to actually track and determine how often or how much this may be costing your business.

Management System Setup

Additional Payment Types must be added to the management system to indicate the type of Short Pay the transaction represents. The typical additional Payment Types are: Short Pay, Customer Goodwill, Warranty, Coupon, Gift Certificates, Collections, Discount, Contra/Barter, Refunds/Rebates. However, this can vary based on your needs.

Depending on the management system, how the payment type is identified, not as a payment but an adjustment can streamline this process even further. For this document, we are assuming that the new payment type will be a payment and not an adjustment entry. If the management system allows for adjustment entries several of the following steps will be eliminated.

Step 1: Receive the deficit balance in the management system with the appropriate payment type.

- In this document we are using "Short Pay".

- Other types will have different distribution accounts used in the accounting system.

- Send this into the accounting system.

We will be using QuickBooks in this document for this process, but the process is basically the same regardless of the accounting system. They also require some setup for this process.

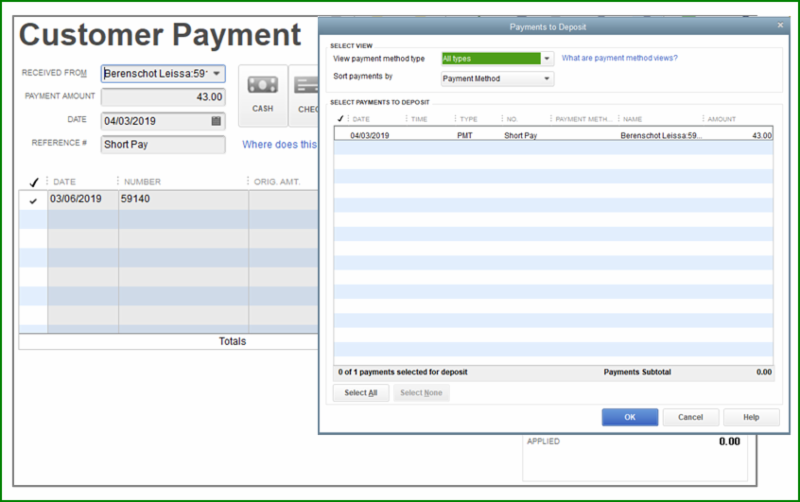

In this example, we will using a simple single job, Repair Order 59140, with a total of $318.00. When payment was received it was Short Paid by $43.00 and we do not expect additional payment.

The process that follows will properly address the Accounts Receivables Balance, track the Short Pay, and allow for a Sales Tax Adjustment.

Step 2: Deposit the Short Pay in Adjustment Bank Account *

- Note: Item clearly identified "Short Pay"

This Step is not needed if management system can create an adjustment rather than a standard payment type.

This process is used regardless for Short Pay, Customer Goodwill, Coupon, etc.

*The Adjustment Bank Account is part of the necessary QuickBooks setup process.

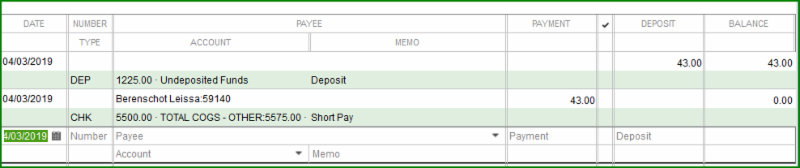

Step 3: Open Adjustment Bank Account Register

- Add an entry on the same date as the Deposit redistributing the same

amount to the proper General Ledger (GL) Account.

The account being used is a COGS Account 5575.00 - Adjustments and Shortages

- It is can be setup as a Contra Income Account on the financial statements and it will

be a negative Income Account. I just prefer the number listed as a positive in COGS.

At this time the Account Balance for the Customer is zero, the Adjustment Account is zero, and the amount of the Short Pay is being tracked in the 5575.00 Account.

This account should be reviewed monthly to determine the extent and costs Short Pays are having in your business.

In addition, the sales report from the management system will match accounting; the Accounts Receivables report of both systems will also match.

Sales Tax Adjustments

Over the years, some shops have indicated that this method will require them to pay Sales Tax on sales they do not collect and has been their justification for leaving Repair Orders open and not closed.

How big of a problem is it really?

Depending on the extent of Short Pays that occur in each month typically this is a very small amount. You should determine if these few dollars is worth the time to calculate the credit for Short Pays on your Sales Tax returns.

There are some additional considerations such as whether all income accounts are taxable or not to consider as well. In some States only certain items are taxable such as Parts and Paint/Materials, while other States have additional taxable items, and some tax all income items.

For instance if the total amount of Short Pays for the month total to $500.00 and your State taxes everything, is the time required to do this worth $22.50 - $45.00 (Depending your tax rate) ? If you do not tax all income items this would be even a smaller amount.

For this above reason, we have seen shops use Credit Memos in QuickBooks to handle Short Pays. Keep in mind, using a Credit Memo will affect the Total Sales Amount, and then cause the management system sales report to not match the accounting report. This then requires adjusting the management system Accounts Receivables as well.

The only exception to this is if the Credit Memo is dated in the following month instead of the same month. This is simply not worth the time required, and is not the best method to use.

How to Adjust the Sales Tax

There is a fairly easy and straight forward method of taking the credit for the "Short Pays" when paying the Sales Tax through QuickBooks.

Sales Tax should always be paid through the Sales Tax process built into QuickBooks.

Go to: Vendors Menu > Sales Tax > Manage Sales Tax

Here access the Sales Tax Liability Report, Pay Sales Tax, and Adjust Sales Tax.

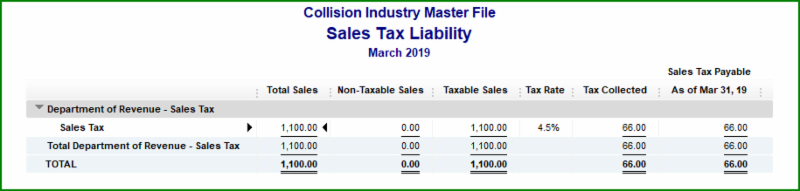

In this simple example there was a total of $1100.00 in total sales.

The tax rate is at 4.5%

The total tax the system thinks you have collected is: $66.00.

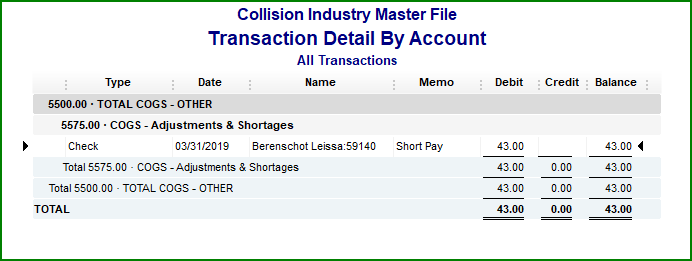

Step 1: Run a Monthly Report on 5575.00

Adjustments and Shortages Account to determine the amount of sales tax credit.

This will reflect the total dollars for the month that you were Short Paid.

If you also utilize other accounts to track Customer Goodwill, Coupons, Discounts, Warranty, etc., you must total all these accounts. This can easily be done by creating a memorized report that includes all the accounts that you utilize.

In this example the $43.00 represents the total dollar shortage and the State taxes all income accounts. Keep in mind, this report amount includes sales tax.

To determine the amount of sales tax it includes, divide the total amount by 1."your tax rate" (1.045 in this example).

Tax Rate is 4.5%, so divide $43.00 by 1.045 which equals $41.15 ... then the difference is sales tax ... ($43.00 - $41.15) ... $1.85.

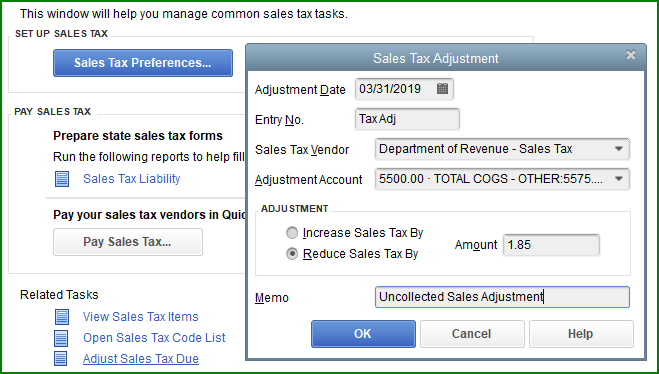

Step 2: Select Adjust Sales Tax Due (Manage Sales Tax) and complete the Adjustment

This Example:

- Entry No. Tax Adj

- Vendor Your Sales Tax Vendor

- Account 5575.00 Shortage Account

- Reduction $1.85

- Memo Uncollected Sales Adjustment

This will create a Journal Entry in the 2200.00 Sales Tax Payable Account as well as the 5575.00 Adjustments and Shortages Account indicating the amount of Sales Tax Credit being taken.

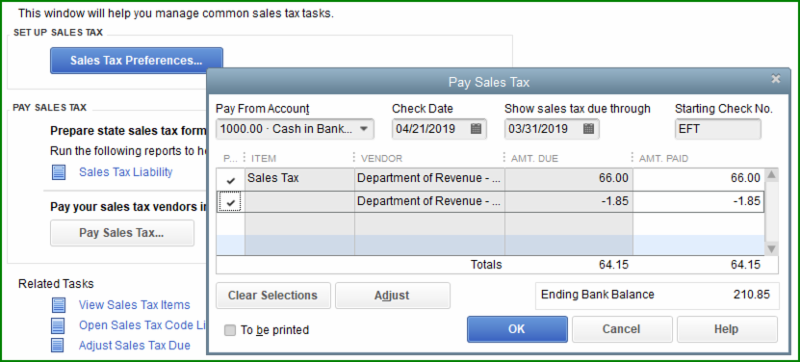

Step 3: Pay Sales Tax

The Pay Sales Window will include the original tax amount on the first line and the credit being taken on the second line.

Be sure to check both lines

In this example you should also notice that "EFT" is in the check number field.

This is because most States I am aware of now require Sales Taxes Paid Online. This online form often allows for a credit for paying on time as well.

(See below Online Form Example - item 5. Collection Allowance)

If your State does offer a credit, you will need to enter the information from our now updated Payroll Liabilities Report to determine your credit, then just add another Sales Tax Adjustment.

This type of adjustment is typically distributed to an Other Income Account such as Rebates and Refunds, or Accounting Discounts.

QuickBooks does not automatically add these credits to the non-taxed column in the Sales Tax Liability Report. You must include the $1.85 (This example) in the Non-Taxable Sales Total but use a positive number.

Once you have paid the Sales Tax Online, review your Pay Sales Tax Screen, make sure all credits are checked and save.

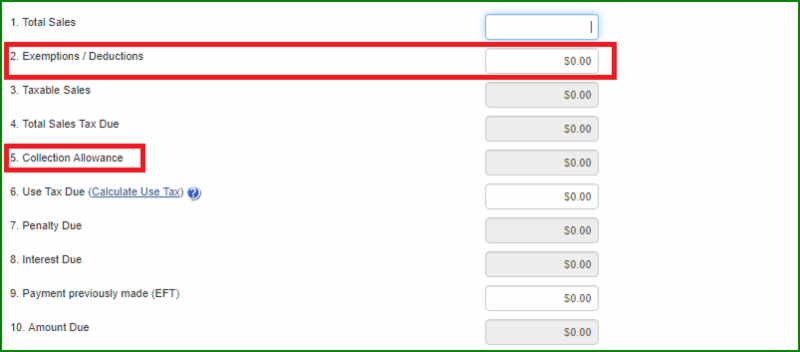

State Online Payment Screens

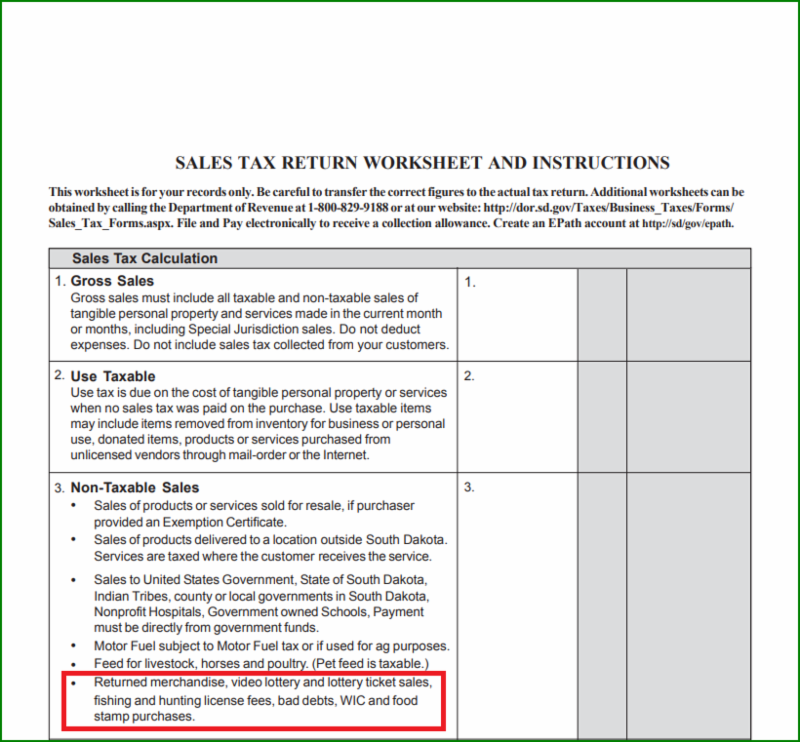

Some clients have asked where the Uncollected Sales Adjustment Credits go on the State's Sales Tax Forms. Most States have similar forms, but they are not exactly the same.

The Amount of the Credit should be added to any other Exempt/Deductions/Non-Taxable Sales.

Other Considerations:

In this example, we took the Short Pay in the same month as the invoice closed. Most likely in the majority of cases, you will be taking the Short Pay in a later month. In these cases, the credit will be taken in the current month and the Payment Dates should be the current month you are taking the credit.

If the management system is capable of sending adjustments into QuickBooks, the process of Depositing the Short Pay into the Adjustment Account and then distributing the amount to the proper account is not necessary, it is done automatically.

State Taxes Do Not Tax All Income Accounts

If your State does not tax all items determining how much of the total Short Pay includes Sales Tax is very subjective. Was it all parts, then it is all taxable. If it was labor, it may not be taxable in your State.

As a general rule Part + Materials usually represent close to 50% of the sales invoice, so if you State only actually does tax Parts and Materials, you may decide to use this as a basis to calculate the Sales Tax credit.

Sales Tax - Accrual or Cash Basis

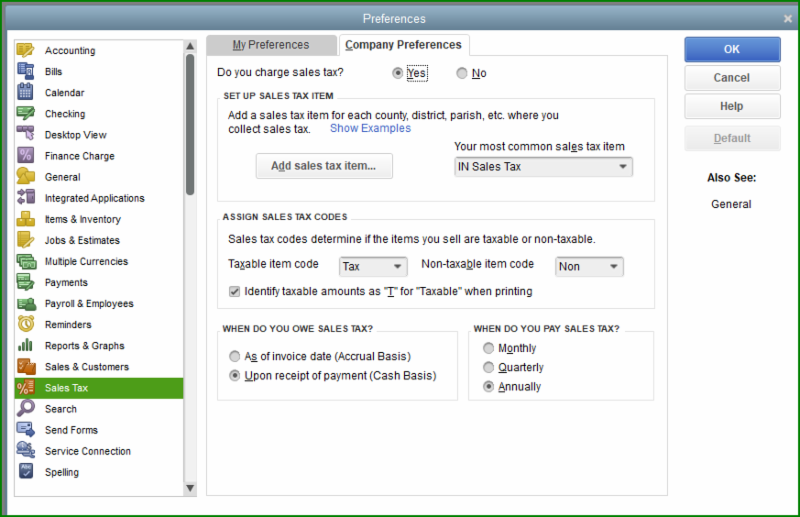

In QuickBooks, in the Sales Tax setup, the default setting is to pay sales tax on an accrual basis. In other words you take the sales tax liability as soon as you invoice the job. Many States require this.

However, there is a setting to pay sales tax on a "cash basis".

Preferences > Sales Tax > Company Preferences Tab

With this setting, you take the sales tax liability as you receive payments. The system in fact on an individual Repair Order basis determines the ratio of taxable verses non-taxable dollars for the job, and uses this ratio to determine your sales tax liability as you receive payments.

If your State taxes all income accounts the ratio would be 100% taxable. This setup when your State doesn't tax everything can be very confusing to an auditor, but you can create a few memorized reports that clearly shows that the proper taxes have been paid.

Even with this setup, the same Short Pay Process should be used and the credits taken the same. It however is not going to be easy to calculate the exact ratio as QuickBooks does automatically if your State does not tax everything. In these cases, I would suggest resorting back to the split as explained earlier.

In Review:

- The Key Points to This Process Are:

- Close RO's When the Vehicle Leaves and Send to Accounting

- Do Not Readjust RO's or QuickBooks

- Invoices for Deficits

- Track Deficits in Categories in QuickBooks

- Use the QuickBooks Process to Pay Sales Tax

- Take Credits Based on the Reports in QuickBooks

I hope this explained a more streamlined process to follow when it is regards to Short Pays and other deficient payments.